8 Ways To Raise Financially Sound Kids to Save-Spend-Invest

The Best Financial Digital Tool For Kids

As parents, we all want our children to know how to manage, save and invest their own money for financial security. Speaking from experience, it takes lots of practice to master money management. Yes?

There are eight ways to raise financially sound kids and confident responsible adults. From starting with the basics from an early age to using the best digital tools including debit cards and investing tools for kids. Yes, I said debit card and investing!

Our Personal Experience Raising Our First Born

The other night, we were chatting with our oldest son (who is now living on his own) about his investments, rent, and other adulting finances that he is responsible for.

It was one of many financial discussions we have had since he was four or five years old. It’s part of raising resilient kids.

He told us how much he appreciated the opportunity to learn how to manage his money early on—an a-ha moment for sure. It’s been so rewarding to watch Jake use the money he has saved and successfully invest it.

I’ll never forget that little Jake told us he was saving to buy a house someday with the money he had earned and saved. It’s hard to believe that he may be buying his first home in the next few years.

Eight Ways To Raise Financially Responsible Adults

There are eight ways parents can teach children about the benefit of making sound financial decisions:

1. Instill the Value Of The Dollar

kids are watching you spend money every day. They see you purchase items with credit cards and cash. So it’s essential to teach them from a young age that money isn’t just for spending- they should be saving money too.

Saving money teaches kids all about delayed gratification and social responsibility. Learning the value of money and the importance of saving money builds independence and security.

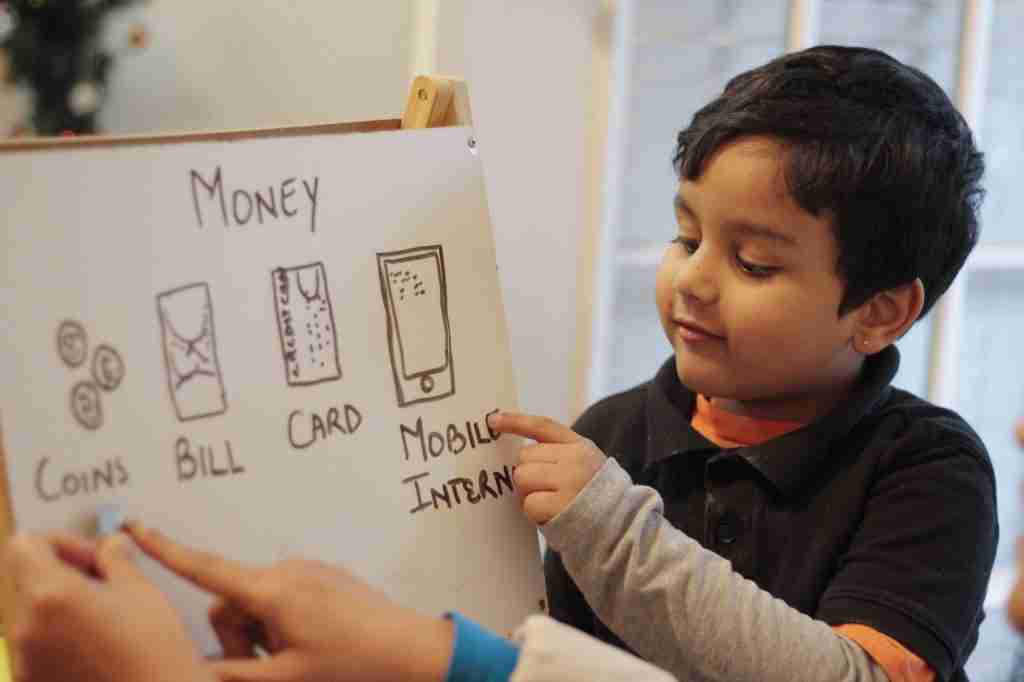

2. Start With the Basics at a Young Age

Explain what money is and how it is used. You know, the basic concept of money. Showing them how money works is more effective. So let them see you making purchases with cash.

Even if you pay with a debit or credit card, explain to your kids that you’re using your money to make purchases.

Piggy banks (clear piggy banks are best) or even money jars are always good for younger kids to start saving money. Setting up a pretend store using play money is a perfect opportunity for children to learn money concepts as well.

Watching the money pile up provides a simple lesson on self-control and how money can grow with time, especially compound interest. Reinforcing saving habits with positive messages such as “saving is fun!” “I love to save” “It feels good to see my money grow”.

With young kids, though, you’ll likely have more luck teaching them to save for short-term goals—such as a toy they want—rather than for the future, says Tim Sheehan, co-founder, and CEO of Greenlight, a debit card for kids with parental controls.

Encouraging Kids to Set Short-term Goals

The father of four says that encouraging his kids to set short-term goals when they have little helped them learn the value of delayed gratification. As they have gotten older, they are now able to save for longer-term goals.

Parents also can encourage their kids to save more by agreeing to match the amount they save dollar for dollar or by a certain percentage. This savings plan has worked for my boys.

If your children are old enough to advance from a piggy bank to an actual bank, you could take advantage of a service such as Greenlight. These prepaid debit cards and apps allow parents to transfer money to their kids and pay them interest—at a rate of their choosing—on any money, the kids choose to stash in savings.

3. Learn To Give Back

Research shows that those with an “attitude of gratitude” in life are happier, less depressed, take stress in stride, and see life with healthy optimism.

In our instant gratification type culture, we know that gratitude and patience takes practice. It’s something we have to teach our kids… To give back with time and our own money. This lesson inspires kids to have more compassion and empathy for those who don’t have as much as they do.

I genuinely believe that we should all teach our kids about the value of giving back to those in our community. The Greenlight app allows kids to create giving accounts so kids can decide who and what they want to support. It is the same idea as a “giving jar” but more advanced.

4. Create Opportunities to Earn Money

Learning how to earn money is key! You can pay your kids allowance, but they are not understanding anything if they are not doing the work.

Set up daily chores and let your kids know what your expectations are for them. If they want their weekly allowance, they need to earn it.

The benefit of providing children with a weekly allowance prepares them to manage a salary as an adult. We encouraged our older son to put together a proposal anytime he requested an allowance increase and even a dog.

This type of request also prepares children for adulthood.

Encourage kids to start a small business and or create neighborhood jobs helping with dog walking, garden work etc.

5. Help Kids Learn to Make Smart Spending and Saving Decisions

Don’t be afraid to let your kids fail. If your child buys a toy with his money and the toy breaks, tough! If you don’t research what you are investing in, you may get cheap products or bad investments.

My older son was always a great saver. He started saving for a house when he was twelve years old. He would save his birthday money and allowance money. We would deposit this money into the bank until he was old enough to invest it. We opened up a Fidelity account with him.

He started investing in stocks in high school and, to this day, loves to trade stocks and watch his money grow. It’s what made him so interested in economics and property investments.

6. Watch the money Grow!

Sheehan (Greenlight CEO) has the same philosophy as Steve and me when teaching kids about investing. Since minors can’t open their accounts, parents have the opportunity to teach kids how to invest so they can keep an eye on the stock market and watch their money grow!

Greenlight has developed some excellent financial teaching tools for kids.

You can help children start investing by opening a custodial account with a brokerage such as Charles Schwab, E*TRADE, Fidelity, or Stockpile..

7. Be an excellent Good Role Model By Being Financially Responsible.

Have open conversations about money and how much things cost. It is also essential to talk with your kids about how working hard can pay off later in life.

Also, it is not how much money you make that matters. It is what you decide to dot with your money is what you will remember.

8.Hard Work

Worth ethic isn’t something you can teach. When we work hard and see the results, we develop a work ethic. Expecting kids to work hard is always a good idea

Raising our Teen With Financial Competence With Help From The Greenlight App

Our experience with Jake has encouraged us to continue our ongoing financial conversations with our younger son Alex. Our dinner table conversations usually include discussions about the country’s economy, the stock market and why specific companies are thriving etc.

When I was introduced to the Greenlight app, I thought it would be fun to offer Alex a digital tool to support his financial education. Also, an opportunity for him to have a safe pre-paid debit card at an early age.

Greenlight is not only a credit card, it’s a money app that teaches kids about money management, set financial goals and develop good money habits.

Keep in mind security is always the first priority. Greenlight uses Mastercard’s Zero Liability Protection, FDIC- insured up to $250,000. It also has fingerprint or facial recognition. So important!

The app doesn’t replace our ongoing conversations about money mind you. It’s the perfect hands-on supplement so kids can learn the basic financial concepts and much more.

How Does Greenlight Work?

So how does it work? Greenlight Max builds off of the Greenlight Card, so you’ll need to sign up and set up your debit cards first. After that, Kids will be able to research stocks with analysis powered by Morningstar, in addition to learning from in-app educational content, track their portfolio and propose investments––with parental approval, of course.

The Greenlight Max plan includes safety features like cell phone, purchase and identity theft protection, and the Greenlight Black Card. You can sign up the entire family for $9.98 per month (and no fees for investing!) at greenlightcard.com.

The Wall Street Journal stated how apps like Greenlight teach kids what investing is all about as opposed to gambling in the stock market like with the Game Stop stock rise and fall this year.

The Financial Tool That Supports Parents And Inspires Kids

With the Greenlight app, kids and parents have companion apps with two different experiences.

Kids can save, earn, invest, spend and give — with parent approval on every transaction. They need to learn about all the up and coming payment sources. Parents can choose the same stores where their kids spend, manage chores and allowances, set parent-paid interest rates, and more.

Because Greenlight is a prepaid debit card, kids can’t spend what they don’t have. No overdraft fees. No overspending. No surprises. Jake didn’t have many age-appropriate resources like this when he was growing up.

My Parenting Perspective The Second Time Around

When you have over a decade of years between your kids, you see things from a different perspective the second time around. I wouldn’t change a thing about how we raised Jake. He is just 24 and has a solid financial future already.

One thing that I do see and experience is the phenomenon of the entitled kid syndrome. You know “the ME ME” attitude? So, how do you raise your kids not to be entitled and financially responsible? Not to mention grateful.

Experts note that parents can do several things to teach kids valuable lessons to be financially responsible and grateful adults. In an instant gratification society, it’s not easy to teach delayed gratification.

Even if you’re not teaching your kids, they will learn financial lessons one way or another. If you want to play a vital role in shaping your children’s feelings, thinking, and values about money, you need to give them the gift of financial literacy from an early age.